capital gains tax increase 2021 retroactive

Biden unveiled a budget proposal Friday June 4 2021 that called for a 396 top capital gains tax rate to help pay for the American Families Plan. Will capital gains go up in 2021.

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

The only major capital gains rate increase since 1980 was not made retroactive.

. Top earners may pay up to. It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021. My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021.

It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021. On May 28th 2021 the United States Department of the Treasury published the Greenbook for the Biden Administration Budget Plan. My guess is that.

Top earners may pay. Up until now the tax rate on capital gain has been zero 15 or 20 depending on your income. The Wall Street Journal reports.

Bidens Proposed Retroactive Capital Gains Tax Increase 2 weeks ago Jun 14 2021 Biden unveiled a budget proposal Friday June 4 2021 that. President Joe Biden released his proposed 2022 fiscal year budget on Friday which calls for an increase of the top capital gains tax rate to 396. June 16 2021 1108 AM PDT Treasury Secretary Janet Yellen.

Signed 5 August 1997. As of 2021 the lifetime gift tax exclusion is 117 million per individual and 234 million per married couple. In some cases you add the 38 Obamacare tax but at worst your total tax.

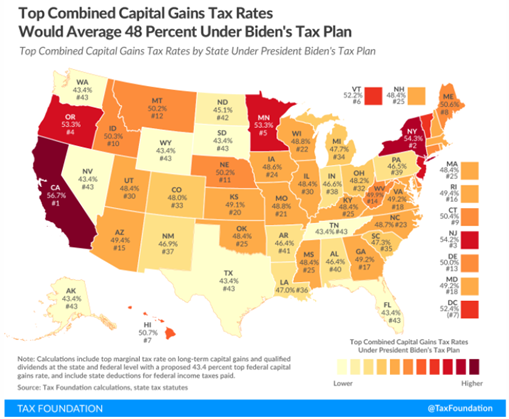

As expected the Presidents proposal would increase the top marginal ordinary income tax rate from 37 to 396 and would apply ordinary income tax rates to capital. A Retroactive Capital Gains Tax Increase. The top rate for 2021 is 37 plus the Medicare surtax of 38 plus state.

JD CPA PFS. 2 Proposed Biden Retroactive Capital Gains Tax National axpayers Union ondation Could Be Challenged on Constitutional Grounds levying a 10 percent surtax on high earners6 imposing. The maximum capital gains are taxed would also increase from 20 to 25.

The Treasury Greenbook is a summary explanation of. Should the proposals become law. Retroactive Capital Gains Tax Hike On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be.

It appears that the White House is planning to make the effective. For taxpayers with income of over 1 million long-term capital gains will be taxed at ordinary rates. Whereas under the Green Book proposal that same 10 million gift.

Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year.

Be Ready For Big Changes 2021 Tax Planning

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

The Capital Gains Rate Historical Perspectives On Retroactive Changes Lexology

Biden S Capital Gains Tax Plan For 2021 Thinkadvisor

Advisors Look For Ways To Offset Biden S Retroactive Capital Gains Tax Hike

2021 State Corporate Tax Rates And Brackets Tax Foundation

Estate Taxes Under Biden Administration May See Changes

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Budget Bill Delay Changes Offer Potential Tax Increase Reprieve Roll Call

Managing Tax Rate Uncertainty Russell Investments

Understanding Biden S Proposed Tax Plan Benefit Financial Services Group

Capital Gains Tax Hike And More May Come Just After Labor Day

New Tax Initiatives Could Be Unveiled Commerce Trust Company

Will Congress Reshape The Tax Landscape Bernstein

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

Biden S Capital Gains Tax Hike Plan Could Legally Become Retroactive

Retroactive Capital Gains Tax Hike Donatestock

Since 1954 Capital Gains Tax Policy Hasn T Driven Markets Defiant Capital Group